Posted on : Dec.8,2019 13:18 KST

|

|

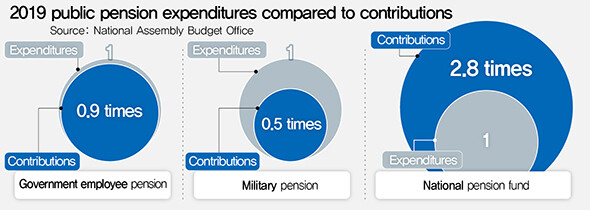

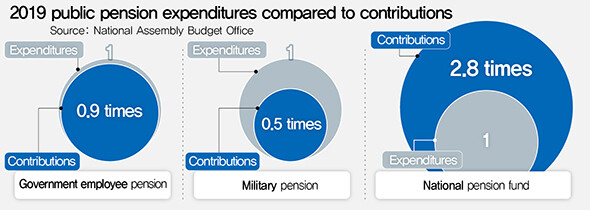

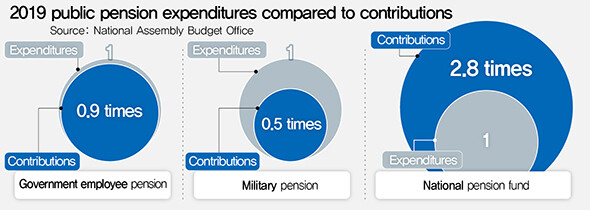

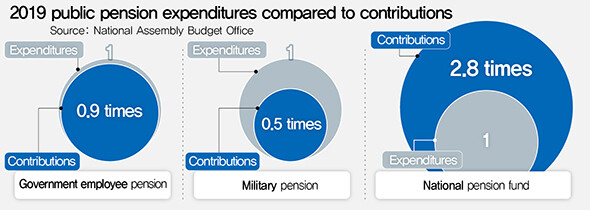

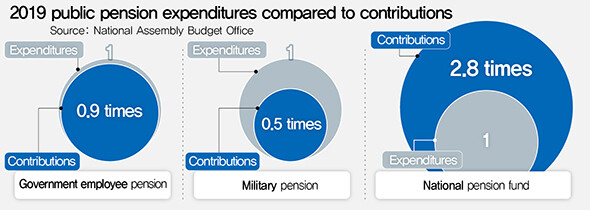

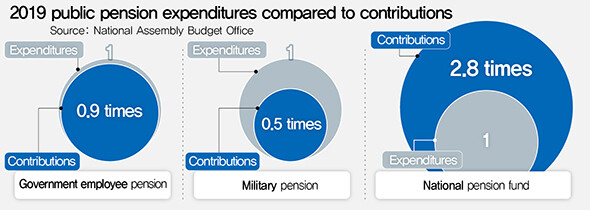

2019 public pension expenditures compared to contributions

|

Military pension expenditures twice the amount being paid in

|

|

2019 public pension expenditures compared to contributions

|

Rapidly rising deficits in the military and government employees’ pension financial balances are leading to predictions that by 2028, pension fund premiums from 100 subscribers will be needed to cover support for at 50 or more beneficiaries. The military pension in particular is facing growing calls for the examination of plans for improvement, with expenditures standing at double the amount being paid in.

According to a report titled “Financial Outlook for the Eight Forms of Social Insurance, 2019-2028” published on Dec. 1 by the National Assembly Budget Office (NABO), the financial surplus for the eight forms of social insurance -- including the national pension, private school pension, government employees’ pension, military pension, health insurance, and senior citizen long-term care insurance -- was predicted to decline by over 40% in 2028, 10

ears in the future. The situation is poised to occur as the 7.8% average annual rate of increase in expenditures for the eight forms of social insurance surpasses the 6.1% rate of increase in revenues amid factors including a rapid population aging trend. The combined surplus for the eight types of insurance is expected to decline by 41.4% from 35.5 trillion won (US$30.01 billion) this year to 20.8 trillion won (US$17.58 billion) by 2028.

The biggest concern in sustainably terms is the military pension. Already operating in the red, the military pension’s deficit is predicted to increase from 1.6 trillion won (US$1.35 billion) this year to 2.4 trillion won (US$2.03 billion) by 2028. With the lowest ratio of revenue to expenditures at 0.5, the military pension is facing the most precarious financial situation -- but the financial burden is expected to increase going forward as the current system is maintained with financial reforms such as increased contributions and decreased pension payouts.

The government employees’ pension is also predicted to face a rapid rise in its financial deficit. The 2.2 trillion won (US$1.86 billion) in losses for the government employee’s pension this year is expected to reach 5.1 trillion won (US$4.31 billion) by 2028. With both the government employees’ and military pension facing difficulties in offsetting expenditures from their reserves (8.8 trillion won [US$7.44 billion] for the former and 1.0 trillion won [US$845.57 million] for the latter as of late 2018), the burden is predicted to fall in state finances unless institutional reforms are carried out. The “system dependency ratio,” or the number of beneficiaries supported by every 100 subscribers, is projected to rise from 43.5 this year to 51.0 in 2028 for the government employees’ pension, and from 51.9 to 54.6 over the same period for the military pension. In other words, more people are set to receive payouts than will be paying into the pensions.

“The military pension in particular had the lowest ratio of revenues to expenditures, with the amount of government support to offset the deficit poised to rise from 1.6 trillion won [US$1.35 billion] this year to 2.4 trillion won [US$2.03 billion] in 2028,” NABO noted in the report.

“[As with the government employees’ pension,] improvements to the military pension will also need to be examined, including a higher contribution rate, adjustments to the pension payout age, and a lower payout rate,” it said.

National pension expected to sustain surplus during same period

Meanwhile, the national pension was predicted to sustain a financial surplus over the same time period. While the surplus is expected to dip slightly from 42.9 trillion won [US$36.27 billion] this year to 40.7 trillion won [US$34.41 billion] in 2028, reserves are expected to rise from 681.7 trillion won [US$576.33 billion] this year to 1,055.9 trillion won (US$892.44 billion) in 2028. Similarly, the private school pension surplus is poised to decline from 1.3 trillion won (US$1.1 billion) this year to 400 billion (US$338.08 million) in 2028, while reserves are projected to rise from 19 trillion won (US$16.06 billion) this year to 25.6 trillion won (US$21.65 billion) in 2028 -- meaning there will be no rapid worsening of the financial situation over the next 10 years.

But with the national pension’s reserves predicted to run out by 2054, the lack of any real debate over institutional improvements such as a higher premium rate was named as an issue in need of addressing. At the same time, the health insurance deficit was projected to increase from 4.1 trillion won (US$3.47 billion) this year to 10.7 trillion won (US$9.04 billion) in 2028 amid the increased guarantees referred to as “Moon Jae-in-care.” The 16.5 trillion won (US$13.94 billion) in reserved is predicted to run out by 2024 as a result. In the case of senior citizen long-term care insurance, the deficit is poised to increase from 800 billion won (US$676.02 million) this year to 6.9 trillion won (US$5.83 billion) in 2028, which means its 600 billion won (US$507.02 million) in reserves as of 2019 will be exhausted by 2022.

“With the eight forms of social insurance relying on subscriber premiums as their chief source of revenues, a backlash from subscribers is very likely to result if financial structure improvements are pursued through increased premiums and/or reduced benefits,” NABO observed in the report.

“Improvements to the social insurance system should be implemented through flexible financial management with a balanced consideration of their role as a social agreement that can be supported by the public,” it said.

By Noh Hyun-woong, staff reporter

Please direct comments or questions to [english@hani.co.kr]